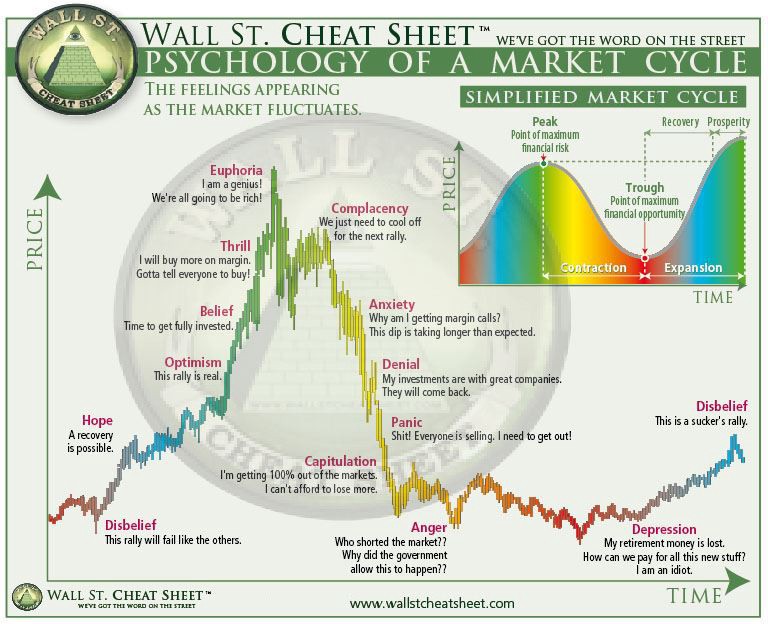

The “Psychology of a Market Cycle” chart, is a visual representation of the different stages of a typical market cycle. The chart illustrates how investors and traders tend to behave during each stage of the cycle, and how their emotions and actions can impact the direction of the market.

The basic stages of a market cycle are typically depicted as follows:

- Accumulation: This stage occurs after a prolonged period of decline, during which savvy investors begin to accumulate positions in anticipation of a rebound.

- Markup: As buying activity picks up, prices begin to rise, creating a positive feedback loop that attracts more buyers and drives prices higher.

- Distribution: Once prices have risen significantly, the smart money begins to sell their positions to less-informed investors who are buying on momentum.

- Markdown: As selling pressure outweighs buying pressure, prices begin to decline, often precipitating a sharp sell-off.

- Panic: During this stage, fear takes hold as investors begin to realize that the market is turning against them. Many investors begin selling their positions in a panic, driving prices even lower.

- Capitulation: In the final stage of the cycle, selling pressure reaches its peak and investors give up hope of any recovery. This is typically when the smart money begins to accumulate positions again, setting the stage for the next cycle to begin.

It’s worth noting that while this chart can be a useful tool for understanding market cycles, it’s important to remember that no two cycles are exactly the same, and past performance is not always a reliable indicator of future results.

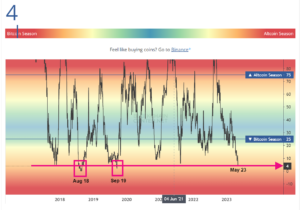

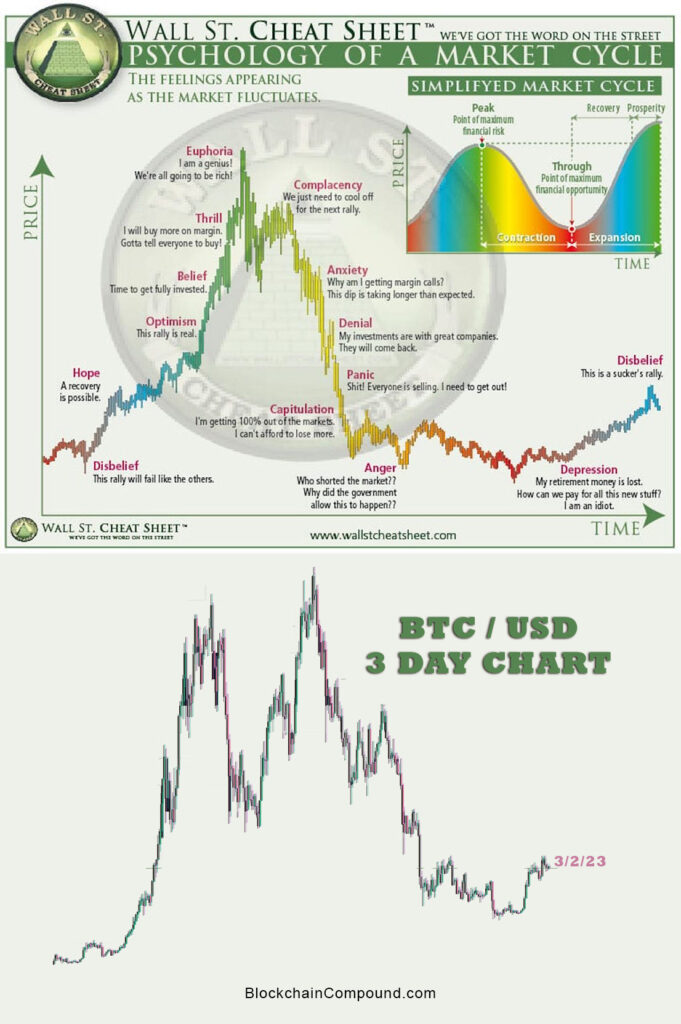

Perspective can also be different from timeframe to timeframe. Currently if you look at the chart below compared to a Bitcoin 3-day chart can you tell in what phase we are?

Let’s break these 6 stages of the market cycle down one by one

Accumulation

This stage occurs after a prolonged period of decline and is characterized by smart investors gradually accumulating positions. They believe that the market has bottomed out and that prices are likely to rise again in the future. During this stage, prices are generally low, and many investors are still fearful of investing. Smart investors use this opportunity to buy undervalued assets, sometimes by employing value investing strategies or by buying at key support levels.

During the accumulation stage, smart investors are typically looking for opportunities to buy assets that are undervalued or oversold. They may be using fundamental analysis to identify companies with strong financials and growth potential, or they may be using technical analysis to identify key support levels or other chart patterns that indicate a potential rebound.

In addition to buying undervalued assets, smart investors may also be accumulating positions in anticipation of a broader market rebound. They may believe that the market has oversold and that prices are due for a rebound, or they may be anticipating positive news or developments that could drive prices higher.

One key characteristic of the accumulation stage is that buying activity is typically concentrated among a small group of savvy investors. These investors are often able to buy assets at a discount, as other investors are still fearful or uncertain about the market. This concentration of buying activity can help to create a solid base of support for prices, as it indicates that there is strong demand for the assets in question.

Another important aspect of the accumulation stage is that it can be a relatively quiet period in the market, with little news or other catalysts driving prices. This can make it difficult for investors to identify opportunities, as there may be few clear signals indicating a potential rebound. As a result, patience and discipline are often key traits of successful investors during this stage.

Markup

As buying activity picks up during the accumulation stage, prices begin to rise, creating a positive feedback loop that attracts more buyers and drives prices higher. This stage can be characterized by strong momentum and bullish sentiment as investors become more optimistic about the market. During this stage, many investors may jump on the bandwagon and buy assets that have already seen significant gains, in the hope of making quick profits.

During the markup stage, buying activity begins to accelerate as prices start to rise. Smart investors who accumulated positions during the accumulation stage are now starting to see gains, which can create positive momentum and attract more buyers to the market. At this stage, the market sentiment is generally bullish, and investors may be feeling optimistic about the future prospects of the market.

The markup stage can be characterized by a number of technical indicators, such as rising moving averages, bullish chart patterns, and strong trading volume. These indicators can provide clues to investors about the direction of the market and potential opportunities for profit.

In addition to technical indicators, the markup stage can also be influenced by a number of fundamental factors, such as positive economic data, strong corporate earnings, or other market catalysts. These factors can help to fuel investor optimism and drive prices higher.

One important consideration for investors during the markup stage is to avoid the temptation to chase gains or get caught up in the hype of a rising market. Instead, investors should focus on identifying solid investment opportunities that are backed by sound fundamentals, such as strong financials, a competitive advantage, and a strong management team.

Overall, the markup stage is a time when buying activity is accelerating, prices are rising, and market sentiment is generally bullish. Smart investors who were able to identify opportunities during the accumulation stage can now reap the rewards of their patience and discipline, while others may be tempted to chase gains or get caught up in the hype of a rising market.

Distribution

As prices rise significantly during the markup stage, smart investors begin to sell their positions to less-informed investors who are buying on momentum. This is known as the distribution stage, and it can be characterized by a shift in sentiment from bullish to neutral or even slightly bearish. During this stage, smart investors may begin to reduce their positions or sell assets outright, knowing that the market is becoming overvalued and due for a correction.

During the distribution stage, smart investors who accumulated positions during the accumulation and markup stages may start to take profits as prices reach new highs. This selling activity can create negative momentum and lead to a shift in market sentiment from bullish to bearish.

One key characteristic of the distribution stage is that selling activity is typically concentrated among a small group of savvy investors. These investors are often looking to sell assets at a premium, as other investors become more optimistic about the market. This concentration of selling activity can help to create a solid ceiling of resistance for prices, as it indicates that there is strong supply of the assets in question.

Another important aspect of the distribution stage is that it can be a relatively quiet period in the market, with little news or other catalysts driving prices. This can make it difficult for investors to identify opportunities to sell, as there may be few clear signals indicating a potential downturn. As a result, patience and discipline are often key traits of successful investors during this stage.

The distribution stage can be characterized by a number of technical indicators, such as falling moving averages, bearish chart patterns, and weak trading volume. These indicators can provide clues to investors about the direction of the market and potential opportunities to take profits.

In addition to technical indicators, the distribution stage can also be influenced by a number of fundamental factors, such as negative economic data, weak corporate earnings, or other market catalysts. These factors can help to fuel investor pessimism and drive prices lower.

Markdown

As selling pressure outweighs buying pressure during the distribution stage, prices begin to decline, often precipitating a sharp sell-off. This is known as the markdown stage, and it can be characterized by fear and panic among investors as they watch the value of their assets plummet. During this stage, many investors may begin to sell their positions, sometimes at a loss, in an effort to avoid further losses.

During the markdown stage, selling activity begins to accelerate as prices start to fall. Smart investors who took profits during the distribution stage may now be looking for opportunities to buy assets at a discount, as prices become oversold and undervalued. At this stage, the market sentiment is generally bearish, and investors may be feeling pessimistic about the future prospects of the market.

The markdown stage can be characterized by a number of technical indicators, such as falling moving averages, bearish chart patterns, and weak trading volume. These indicators can provide clues to investors about the direction of the market and potential opportunities to buy assets at a discount.

In addition to technical indicators, the markdown stage can also be influenced by a number of fundamental factors, such as negative economic data, weak corporate earnings, or other market catalysts. These factors can help to fuel investor pessimism and drive prices lower.

One important consideration for investors during the markdown stage is to avoid the temptation to panic sell or get caught up in the fear of a falling market. Instead, investors should focus on identifying solid investment opportunities that are backed by sound fundamentals, such as strong financials, a competitive advantage, and a strong management team.

Another key characteristic of the markdown stage is that buying activity is typically concentrated among a small group of savvy investors. These investors are often able to buy assets at a discount, as other investors are still fearful or uncertain about the market. This concentration of buying activity can help to create a solid base of support for prices, as it indicates that there is strong demand for the assets in question.

Panic

As prices continue to decline during the markdown stage, fear takes hold as investors begin to realize that the market is turning against them. This can trigger a panic among investors, leading to a rapid and steep decline in prices. During this stage, many investors may sell their positions in a panic, driving prices even lower.

The panic stage is the final stage of the market cycle, characterized by a sudden and dramatic drop in prices, extreme fear and pessimism among investors, and widespread panic selling. At this stage, the market sentiment is generally at its lowest point, with many investors feeling helpless and uncertain about the future of the market.

During the panic stage, selling activity is typically widespread, with investors looking to exit their positions as quickly as possible in order to limit their losses. This can create a downward spiral in prices, as selling begets more selling, leading to a cascade of panicked selling.

One key characteristic of the panic stage is that it can be difficult for investors to determine the true value of assets, as prices may be disconnected from their underlying fundamentals. This can lead to extreme volatility and sharp price swings, making it difficult for investors to make rational investment decisions.

Another important aspect of the panic stage is that it can be a time of significant opportunity for savvy investors who are able to maintain their composure and identify solid investment opportunities. During times of extreme fear and panic, assets can become deeply undervalued, presenting opportunities for investors to buy assets at a steep discount.

However, it is important to note that investing during the panic stage can be extremely risky, and investors should be prepared for significant volatility and uncertainty. It is crucial to focus on investing in companies with strong fundamentals and competitive advantages, as these are the companies that are most likely to weather the storm and emerge stronger in the long run.

Capitulation

In the final stage of the cycle, selling pressure reaches its peak, and investors give up hope of any recovery. This is typically when the smart money begins to accumulate positions again, setting the stage for the next cycle to begin. This stage can be characterized by a sense of despair and resignation among investors as they come to terms with the fact that the market has turned against them. Smart investors use this opportunity to buy undervalued assets again, anticipating that the market will eventually recover.

The capitulation stage is characterized by a final wave of selling, as investors who have held onto their positions through the panic stage finally give up and sell. This wave of selling is often triggered by some sort of catalyst, such as negative economic data or a major market event.

During the capitulation stage, prices can experience a sharp and sudden decline, as investors rush to sell their positions. This selling activity can be widespread and indiscriminate, leading to significant volatility and uncertainty in the market.

One key characteristic of the capitulation stage is that it can be a time of significant opportunity for savvy investors who are able to identify solid investment opportunities. Assets can become deeply undervalued during this stage, as prices become disconnected from their underlying fundamentals.

However, it is important to note that investing during the capitulation stage can be extremely risky, as prices can be highly volatile and unpredictable. Investors should exercise caution and focus on investing in companies with strong fundamentals and competitive advantages, as these are the companies that are most likely to weather the storm and emerge stronger in the long run.

Another important aspect of the capitulation stage is that it often marks the bottom of the market cycle, with prices finally reaching a level that reflects their true underlying value. This can provide a sense of relief and clarity for investors, as the extreme volatility and uncertainty of the panic and capitulation stages begin to dissipate.

Summary

The psychology of a market cycle can be broken down into several stages, including accumulation, markup, distribution, markdown, panic, and capitulation. During the accumulation stage, prices are generally low and investors begin to accumulate positions. The markup stage is characterized by a steady increase in prices, as investors become increasingly optimistic. During the distribution stage, prices begin to plateau as investors begin to sell their positions. The markdown stage is characterized by a slow and steady decline in prices. The panic stage is marked by a sudden and dramatic drop in prices, extreme fear and pessimism among investors, and widespread panic selling. The capitulation stage is characterized by a final wave of selling, often triggered by a catalyst, and can create significant volatility and uncertainty in the market. Overall, the market cycle is a natural part of investing, and understanding the psychology behind each stage can help investors make more informed decisions.

Based on all this here is a weekly chart of Bitcoin…Do you see the pattern. What stage do you think it is currently in?

Online Resources:

These following resources can provide a wealth of information on the psychology of the market cycle, but it is important to remember that investing is inherently risky, and there is no guarantee of success. It is always a good idea to do your own research, consult with a financial advisor, and carefully consider your own investment goals and risk tolerance before making any investment decisions.

- Investopedia: Investopedia is a popular online resource for investors that provides a wide range of educational content, including articles, tutorials, and videos on topics related to investing and finance. They have a comprehensive article on the market cycle, which provides an in-depth overview of each stage and the psychology behind it.

- The Balance: The Balance is another online resource that provides educational content on investing and finance. They have an article on the market cycle that explains each stage in detail, along with tips for how to invest during each stage.

- Seeking Alpha: Seeking Alpha is a platform that provides investment research, news, and analysis from a community of contributors. They have many articles on the market cycle, written by experienced investors and analysts.

- YouTube: There are many YouTube channels that focus on investing and finance, and some of them have videos that explain the psychology of the market cycle in detail. Some popular channels include The Plain Bagel, Two Cents, and Graham Stephan.

- Books: There are also many books that discuss the psychology of the market cycle and provide insights into how to invest during each stage. Some popular examples include “The Psychology of Money” by Morgan Housel, “The Intelligent Investor” by Benjamin Graham, and “Mastering the Market Cycle” by Howard Marks.