Dollar cost averaging is a method of investing that involves buying an equal amount at periodic intervals. This strategy is designed to minimize the effect of market volatility on your overall portfolio returns. In this article, we will examine the concept of DCA more closely, give some examples of how to use it, discuss why it can be beneficial and outline steps for creating a calculator to determine your position in relation to DCA.

What is Dollar Cost Averaging?

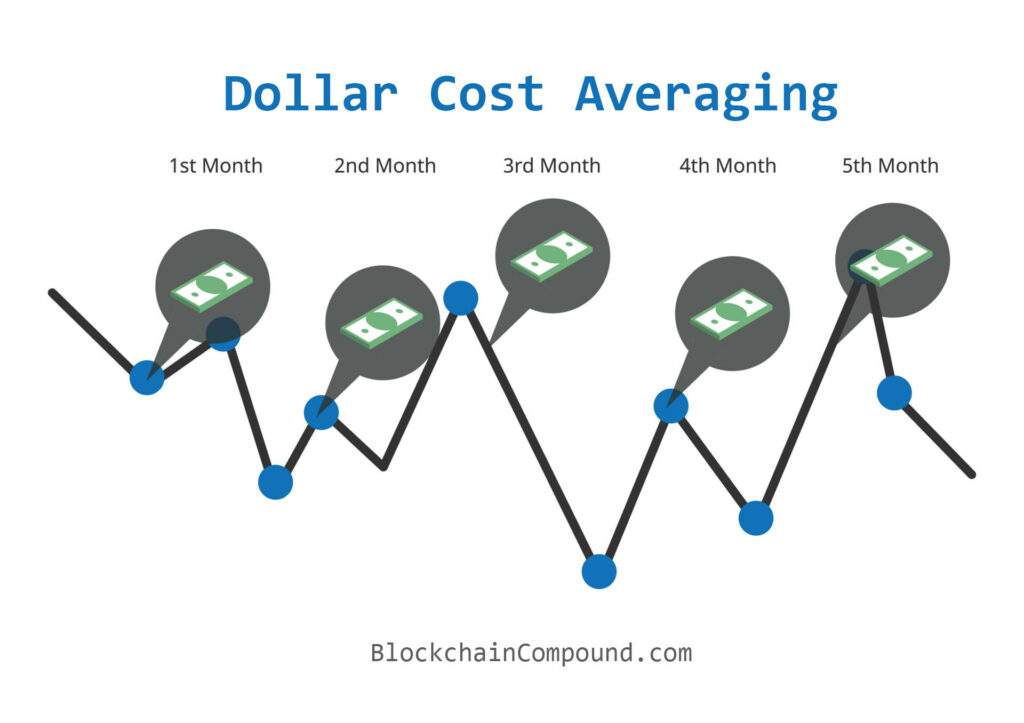

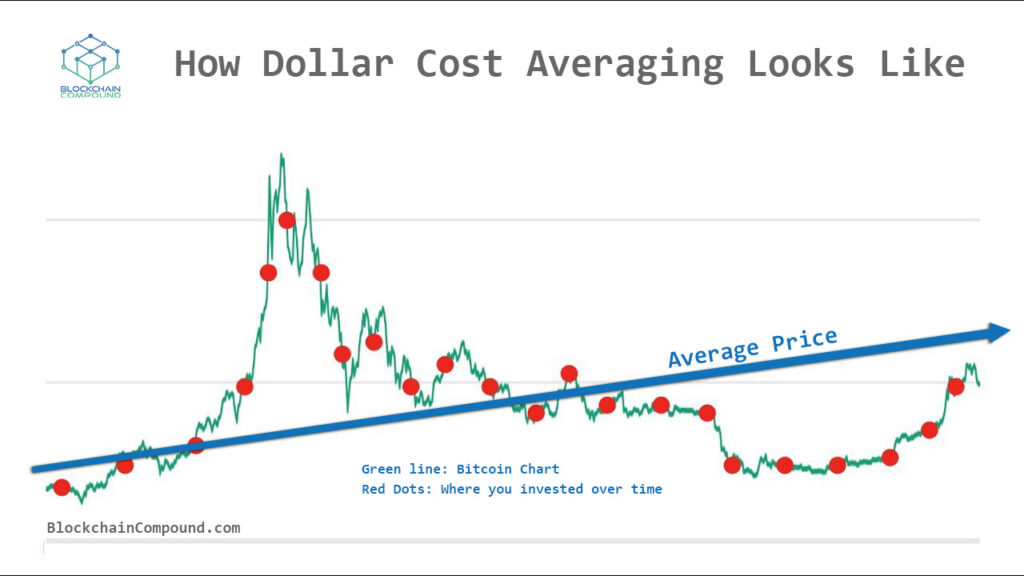

Dollar cost averaging is an investment technique that allows investors to invest a fixed amount of money at regular intervals, regardless of the current market conditions. This means that if the market is high, an investor will purchase fewer shares with the same amount of money, and if the market is low, they will purchase more shares. The result is that over time, an investor will purchase shares at different prices, resulting in an average cost per share.

For example, suppose an investor decides to invest $500 per month in a mutual fund. If the share price is $50, they will purchase 10 shares. If the share price is $25, they will purchase 20 shares. Over time, the investor will have purchased shares at different prices, resulting in an average cost per share.

Why is Dollar Cost Averaging a Good Strategy?

Dollar cost averaging is a good strategy for several reasons. First, it eliminates the need to time the market. Market timing is difficult, and even professional investors struggle to consistently time the market. By investing a fixed amount of money at regular intervals, an investor can avoid the temptation to try and time the market and instead focus on building a diversified portfolio.

Second, dollar cost averaging reduces the impact of market volatility on investment returns. Markets can be volatile, and prices can fluctuate wildly in the short term. By investing a fixed amount of money at regular intervals, an investor can take advantage of both up and down markets, resulting in a lower average cost per share.

Third, dollar cost averaging is a simple and convenient way to invest. Once an investor sets up a dollar cost averaging plan, they can sit back and let their investments grow over time. This can be a good option for investors who don’t have the time or expertise to actively manage their investments.

Figuring out your DCA Price when buying crypto

You can download this basic calculator (excel) to help you calculate your average price if you have purchased a particular coin at different amounts and times. This way you will know how much it has to go up in order for you to be in profit.

Examples of Dollar Cost Averaging

To illustrate the power of dollar cost averaging, let’s look at two examples.

Example 1: John decides to invest $10,000 in a mutual fund. He invests the entire amount at once and the share price is $100. Six months later, the share price has dropped to $75. John’s investment is now worth $7,500.

Example 2: Sarah decides to invest $10,000 in the same mutual fund as John, but she decides to use a dollar cost averaging strategy. She invests $1,000 per month over 10 months. During this period, the share price fluctuates between $80 and $70. At the end of 10 months, Sarah’s investment is worth $10,523.

As you can see, dollar cost averaging can help investors avoid the impact of market volatility on their investment returns.

Summary

Dollar cost averaging is a simple and effective investment strategy that can help investors avoid the impact of market volatility on their investment returns. By investing a fixed amount of money at regular intervals, an investor can build a diversified portfolio and take advantage of both up and down markets. By building a dollar cost averaging calculator, investors can estimate their position and make informed investment decisions.