Compound interest calculators are like financial wizards, but with a slightly boring sense of humor. They take your initial investment and sprinkle it with some magical compounding fairy dust, and then calculate the potential future value of your money over time.

They’re kind of like virtual piggy banks, but instead of storing your change in a cute little animal-shaped container, they transform your money into a rapidly growing pile of cash.

But be careful, because if you’re not careful with your inputs, you might end up with a future value that’s way too high for your liking. It’s like accidentally pouring too much sugar into your coffee – you might end up with a sickly sweet result that’s hard to swallow.

So, while compound interest calculators might not be the most exciting tool in your financial toolkit, they can certainly help you make some smart money moves. And who knows, maybe one day they’ll develop a sense of humor that’s as clever as your own.

Our compound interest calculator tool is a simple and easy-to-use tool that helps you calculate the interest you’ll earn on your savings over time. It has a few input fields that you’ll need to fill out in order to get an accurate calculation.

First enter your “Initial Deposit Amount.” This is the initial amount of money you’re going to deposit into your savings account.

The second input field is for “Contributions” This is the any additional amount you plan to add to the account. You can leave this at zero as well.

Then choose the frequency of those contributions. Monthly or annually.

Next select the “Number of Years.” This is the number of years you plan to save your money for.

The next input field is for the “Interest Rate.” This is the annual interest rate that your savings account earns. It’s important to note that this rate is expressed as a percentage.

Finally you need to pick the “Compound Frequency.” This is how often the interest is compounded or added to the principal balance. It can be annually, semi-annually, quarterly or monthly.

Once you’ve filled out all of the input fields, simply hit the “Calculate” button and the tool will give you the total interest earned and the final amount in your account after the specified number of years.

You can also use the tool to compare different scenarios by changing the input fields to see how it affects the final amount.

It’s important to note that compound interest is a powerful force that can help your money grow over time, but it can also work against you if you have debt with high-interest rates. It’s a good idea to use this tool to help you plan for your future financial goals.

Did you know?

With daily compounding, the interest earned on an investment is added to the principal balance every day. This means that the investment balance grows faster than it would with monthly, weekly, or yearly compounding because interest is being earned and added to the account more frequently.

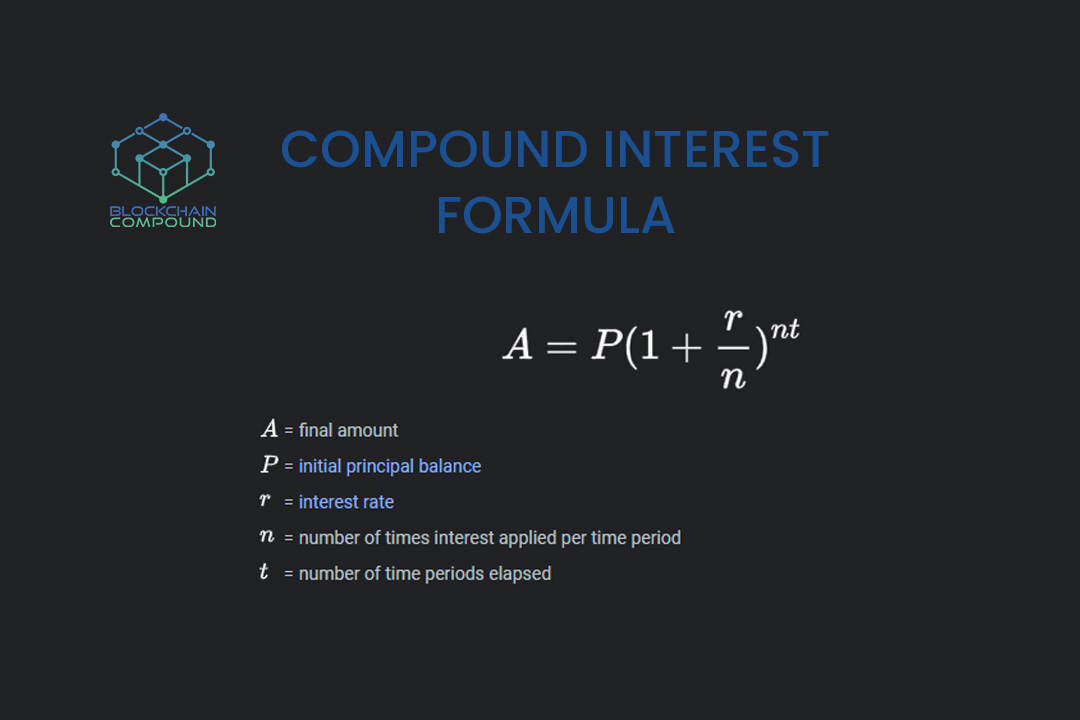

Compound Interest Formula

The formula for calculating compound interest is:

A = P(1 + r/n)^(nt)

where:

A = the amount of money at the end of the investment period

P = the principal, or the initial amount of money invested

r = the annual interest rate (expressed as a decimal)

n = the number of times the interest is compounded per year

t = the number of years the money is invested

Here’s how the formula works. The term (1 + r/n) represents the factor by which the principal amount grows after one compounding period. For example, if the annual interest rate is 5%, and interest is compounded monthly, then n = 12 and (1 + r/n) = 1 + 0.05/12 = 1.004167. This means that after one month, the principal amount will grow by 0.4167%.

The term (nt) represents the total number of compounding periods over the investment period. For example, if the money is invested for 3 years, and interest is compounded monthly, then n = 12 and t = 3, so nt = 36.

So, when we raise (1 + r/n) to the power of (nt), we get the factor by which the principal amount grows over the entire investment period. Finally, we multiply this factor by the initial principal amount P to get the final amount A.

The power of compounding interest is that the interest earned in each compounding period is added to the principal amount, so the interest earns interest. This can result in a significant increase in the total amount of money earned over time, compared to simple interest, where only the principal earns interest.

Little Timmy learns about Compound Interest

Once upon a time, there was a little boy named Timmy. Timmy was always curious about how money worked and how people became rich. One day, while browsing the internet, he came across the concept of compound interest. He learned that if you invested a small amount of money, and let it grow over time, the interest earned on that investment would also earn interest, leading to exponential growth.

Timmy was fascinated by this concept, and decided to put it into practice. He saved up his allowance and put it into a savings account that earned interest. He was determined to watch his money grow, and checked the balance every day.

As he grew older, Timmy continued to invest and save. He learned about different types of investments and diversified his portfolio. He also continued to educate himself about personal finance and the stock market.

By the time Timmy was in his 30s, he had become very successful. His investments had grown significantly and he was able to retire early. He now had enough money to do whatever he wanted, and he was grateful for the lesson he learned as a child about compound interest.

Timmy’s story goes to show that even a little bit of money, invested wisely and allowed to grow over time, can lead to great wealth. The moral of the story is that, it’s never too early to start thinking about your financial future and the power of compound interest.