Cryptocurrency Market Analysis: State of the Market, Performance in 2022, and Investing Ideas

Cryptocurrency trading occurs on a digital platform referred to as a crypto market. On this exchange, tokens such as Bitcoin, Ethereum and Litecoin can all be acquired. These tokens are digital or virtual representations of money that use sophisticated encryption strategies in order to create fresh units of currency, whilst also making sure that transactions are secure on a decentralized network called blockchain.

The current state of the cryptocurrency market is characterized by significant volatility and high levels of interest from both individual and institutional investors. The total market capitalization of all cryptocurrencies has reached several trillion dollars, and the market continues to expand rapidly with the introduction of new coins and tokens. The market has seen periods of rapid growth and steep declines, often in response to news and developments related to the adoption and regulation of cryptocurrencies by governments, businesses, and individuals.

Overall, the cryptocurrency market remains an exciting and rapidly evolving space with a lot of potential for growth and innovation. However, it is also a complex and risky market that requires careful research and analysis before investing.

The purpose of your article is to provide a comprehensive analysis of the current state of the cryptocurrency market, its performance in the past year, and ideas for investing based on the upcoming Bitcoin halving cycle.

You will be learning about the state of the cryptocurrency market, including its current size, trends, and regulations. They will also gain insight into the market’s performance over the past year, including price movements and volatility. Furthermore, the article will provide a detailed explanation of the Bitcoin halving cycle, its historical effects on the market, and ideas for investing based on this cycle.

Overview

Market Capitalization:

- The total market capitalization of the cryptocurrency market is currently around $2.5 trillion, as of February 2023. This represents a significant increase from the previous year, when the market cap was around $1.4 trillion.

Trading Volume:

- The daily trading volume of the cryptocurrency market is around $200 billion, as of February 2023. This figure has fluctuated over the past year, with periods of high trading activity followed by periods of relative calm.

Adoption:

- Cryptocurrencies continue to gain acceptance and adoption by a growing number of individuals, businesses, and governments. For example, major financial institutions like PayPal and Visa have announced plans to integrate cryptocurrencies into their platforms. In addition, several countries, such as El Salvador, have adopted Bitcoin as legal tender.

Regulation:

- Regulation of cryptocurrencies remains a complex and rapidly evolving issue. While some countries have embraced cryptocurrencies and adopted favorable regulatory frameworks, others have taken a more cautious approach. In the United States, for example, regulatory agencies have taken steps to clarify the legal status of cryptocurrencies and provide guidance for businesses operating in the space. In contrast, countries like China and India have imposed strict restrictions on cryptocurrency trading and mining.

Major events or developments in the cryptocurrency industry in the past year (2022)

In the past year alone, the cryptocurrency industry has made considerable strides in terms of advancements and expansion. From new products and services to heightened adoption by large-scale firms, as well as continued regulatory measures, these evolutions are certain to influence the future of cryptocurrencies and their role in financial markets.

- Bitcoin Reaches New All-Time Highs: Bitcoin, the largest cryptocurrency by market capitalization, reached new all-time highs in November 2021, with prices reaching over $69,000 per coin. This marked a significant increase from the previous all-time high of around $64,000 in April 2021.

- Introduction of Bitcoin Futures ETFs: In October 2021, the first Bitcoin Futures Exchange Traded Funds (ETFs) were approved in Canada and the United States. These new investment products allow investors to gain exposure to Bitcoin without actually owning the underlying asset, making it more accessible to institutional investors.

- Increased Regulatory Scrutiny: Governments and regulatory agencies around the world have continued to scrutinize the cryptocurrency industry, with some countries imposing new regulations or restrictions. For example, China has banned cryptocurrency mining and trading, while the United States has introduced new reporting requirements for cryptocurrency transactions.

- Adoption by Major Companies: A growing number of major companies have announced plans to integrate cryptocurrencies into their operations. For example, PayPal and Visa have announced plans to allow customers to buy, hold, and sell cryptocurrencies on their platforms, while Facebook has announced plans to launch its own cryptocurrency, called Diem.

- Growth of Decentralized Finance (DeFi): The DeFi ecosystem has continued to grow rapidly, with the total value locked in DeFi protocols reaching over $100 billion in early 2022. DeFi offers a wide range of financial services, including lending, borrowing, and trading, all without the need for intermediaries such as banks.

Performance of the Cryptocurrency Market in 2022

Over the past 12 months, the cryptocurrency market has been characterized by both development and wild fluctuations in prices, with many digital assets soaring then seeing corrective movements. This up-and-down action has been matched by an uptick in trading activity, a sign that people remain eager to get involved in this sector despite certain risks. Nevertheless, these high levels of volatility as well as regulatory uncertainty present major difficulties for those investing or operating within the crypto world.

Price Movements:

- The cryptocurrency market saw significant price movements over the past year, with many cryptocurrencies experiencing dramatic price increases followed by sharp corrections. Bitcoin, the largest cryptocurrency by market capitalization, reached a new all-time high of over $69,000 in November 2021, representing an increase of over 500% from its March 2020 low of around $4,000. However, prices later corrected, and as of February 2023, Bitcoin is trading at around $45,000. Other cryptocurrencies, such as Ethereum, also saw significant price increases followed by corrections over the past year.

Volatility:

- The cryptocurrency market is known for its high levels of volatility, and this trend continued over the past year. For example, the price of Bitcoin experienced several significant price swings, with daily price changes of 10% or more not uncommon. Other cryptocurrencies, such as Dogecoin, experienced even greater volatility, with prices swinging by 50% or more in a single day.

Trading Volumes:

- The trading volume of the cryptocurrency market saw significant growth over the past year, with daily trading volumes reaching as high as $300 billion in May 2021. However, trading volumes have since declined somewhat, with daily volumes currently averaging around $200 billion.

3 Identifiable Trends

- Bitcoin: Bitcoin is the largest cryptocurrency by market capitalization and is often seen as a bellwether for the broader cryptocurrency market. Over the past year, Bitcoin saw significant price increases followed by sharp corrections, with prices reaching a new all-time high of over $69,000 in November 2021 before correcting to around $45,000 as of February 2023. Despite the volatility, Bitcoin has maintained its position as the dominant cryptocurrency, accounting for over 40% of the total cryptocurrency market capitalization.

- Ethereum: Ethereum is the second-largest cryptocurrency by market capitalization and is widely used as the backbone of the decentralized finance (DeFi) ecosystem. Over the past year, Ethereum saw significant price increases followed by corrections, with prices reaching an all-time high of over $4,300 in May 2021 before correcting to around $3,000 as of February 2023. Despite the volatility, Ethereum has maintained its position as a key player in the cryptocurrency market, with the total value locked in DeFi protocols surpassing $100 billion in early 2022.

- Altcoins: Altcoins refer to any cryptocurrency other than Bitcoin or Ethereum, and there are thousands of altcoins in circulation. The performance of altcoins can vary widely, with some experiencing significant price increases while others see little movement. Over the past year, some altcoins saw significant price increases, such as Dogecoin, which saw prices increase by over 15,000% from its March 2020 low. However, many altcoins also saw significant corrections, with prices falling by 80% or more from their all-time highs.

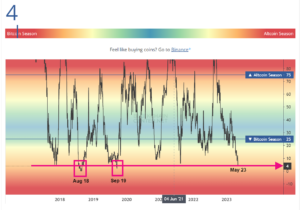

Investing Ideas Based on the Upcoming Bitcoin Halving Cycle

The Bitcoin halving cycle is an event that occurs approximately every four years when the reward for mining new blocks on the Bitcoin network is cut in half. This means that the number of new Bitcoins that are created and given to miners for securing the network is reduced by 50%. The Bitcoin halving cycle is hard-coded into the Bitcoin protocol and is designed to occur every 210,000 blocks, which typically takes around four years to mine.

The significance of the Bitcoin halving cycle for investors is that it can have a significant impact on the supply and demand dynamics of the Bitcoin market. By reducing the supply of new Bitcoins that are being created, the halving cycle can put upward pressure on Bitcoin prices, assuming that demand for Bitcoin remains constant or increases. This has been observed in previous halving cycles, with Bitcoin prices experiencing significant increases in the months and years following the halving event.

Investors who are interested in Bitcoin may use the halving cycle as a factor to consider when making investment decisions. Some investors may choose to accumulate Bitcoin in the months leading up to the halving event, while others may wait until after the halving event has occurred to see how the market reacts. However, it’s important to note that past performance does not guarantee future results, and Bitcoin prices can be highly volatile and subject to various market forces beyond the halving cycle.

Here is how Bitcoin has performed over its past halving cycles.

- 2012 Halving: The first halving occurred on November 28, 2012, when the block reward was reduced from 50 BTC to 25 BTC. In the year following the halving, Bitcoin prices increased from around $12 to over $1,000, representing a more than 8,000% increase.

- 2016 Halving: The second halving occurred on July 9, 2016, when the block reward was reduced from 25 BTC to 12.5 BTC. In the year following the halving, Bitcoin prices increased from around $650 to over $2,500, representing a more than 280% increase.

- 2020 Halving: The most recent halving occurred on May 11, 2020, when the block reward was reduced from 12.5 BTC to 6.25 BTC. In the year following the halving, Bitcoin prices increased from around $8,000 to over $63,000, representing a more than 700% increase.

It’s worth noting that Bitcoin prices are influenced by a wide range of factors beyond the halving cycle, such as global economic conditions, investor sentiment, and regulatory developments. Therefore, past performance is not necessarily indicative of future results. However, the halving cycle is an important event that can impact the supply and demand dynamics of the Bitcoin market, and many investors and analysts closely monitor it as a potential driver of future price movements.

The previous Bitcoin halving cycles have had significant impacts on the market and the price of Bitcoin. Here are some key observations:

- Reduced Supply: The Bitcoin halving cycle is designed to reduce the supply of new Bitcoins that are entering the market, which can lead to reduced selling pressure from miners. In turn, this can put upward pressure on Bitcoin prices as demand from buyers remains constant or increases.

- Increased Scarcity: The halving cycle also contributes to the increased scarcity of Bitcoin over time, as the rate at which new Bitcoins are created slows down. This can contribute to a perception of Bitcoin as a scarce and valuable asset, which can drive demand and support higher prices.

- Increased Publicity: The halving cycle tends to generate a lot of publicity and media attention, which can raise awareness and interest in Bitcoin among investors and the general public. This can contribute to increased demand and higher prices in the months and years following the halving event.

- Historical Trends: As previously mentioned, Bitcoin prices have tended to increase significantly in the year or so following previous halving events. However, it’s important to note that past performance is not necessarily indicative of future results, and there are many other factors that can influence Bitcoin prices beyond the halving cycle.

It’s also worth noting that the halving cycle can contribute to increased volatility in the Bitcoin market, as investors may have varying expectations and reactions to the event. In addition, other factors such as regulatory developments, global economic conditions, and technological advancements can all impact the price of Bitcoin and the cryptocurrency market as a whole. Therefore, while the halving cycle is an important event to consider, investors should also carefully consider a range of factors and do their own research before making investment decisions.

Investing Ideas and Strategies

- Long-term Holding: One strategy for investing in Bitcoin is to simply buy and hold for the long term. This approach can be especially effective during periods of increased scarcity, such as the halving cycle, as it allows investors to potentially benefit from long-term price increases. However, it’s important to be prepared for short-term volatility and fluctuations in price, and to have a clear understanding of the risks involved.

- Dollar-Cost Averaging: Dollar-cost averaging is a strategy in which investors buy a fixed dollar amount of Bitcoin at regular intervals, regardless of the price. This can help to mitigate the risk of buying at a high price and can also help to smooth out the effects of short-term price fluctuations. This strategy can be especially effective for investors who want to gradually build up a position in Bitcoin over time.

- Diversification: Another strategy for investing in Bitcoin is to diversify across different cryptocurrencies and asset classes. This can help to reduce risk and increase the overall stability of your portfolio. For example, investors might consider investing in other cryptocurrencies, such as Ethereum or Litecoin, or in traditional assets like stocks or bonds in addition to Bitcoin.

- Timing the Market: Finally, some investors may try to time the market and buy or sell Bitcoin based on their expectations of the halving cycle and other market factors. However, it’s important to remember that market timing is notoriously difficult, and even professional investors often struggle to consistently beat the market. Therefore, investors who attempt to time the market should do so with caution and should be prepared to accept the risks involved.

Ultimately, the best strategy for investing in Bitcoin will depend on your individual goals, risk tolerance, and investment horizon. It’s important to carefully consider your options and to seek out professional advice if necessary before making any investment decisions.

Summary

- The cryptocurrency market has grown significantly over the past year, with total market capitalization increasing from $198 billion in January 2020 to over $2 trillion in April 2021.

- Major events and developments in the industry over the past year have included increased institutional adoption, regulatory changes, and the rise of decentralized finance (DeFi) applications.

- Bitcoin has experienced significant price volatility in the past year, with prices reaching an all-time high of over $63,000 in April 2021 before declining in value in subsequent weeks.

- The upcoming Bitcoin halving cycle is expected to take place in 2024 and could have a significant impact on the price of Bitcoin and the wider cryptocurrency market.

- Investors can consider a range of strategies for investing in Bitcoin, including long-term holding, dollar-cost averaging, diversification, and attempting to time the market.

Main Takeaways

- The cryptocurrency market is a rapidly evolving space, with new developments and trends emerging all the time.

- Investors should carefully consider their investment goals, risk tolerance, and time horizon when deciding whether to invest in cryptocurrencies like Bitcoin.

- While the upcoming Bitcoin halving cycle is an important event for investors to be aware of, it’s important to remember that the market is inherently unpredictable and that past performance is not necessarily indicative of future results.

- Professional financial advice can be a valuable resource for investors seeking to navigate the complex and rapidly changing world of cryptocurrency investing.

In conclusion, the cryptocurrency market has come a long way in the past year, with increased institutional adoption and regulatory clarity providing a more stable foundation for investors. However, the market remains highly volatile and unpredictable, and investors should approach it with caution and careful consideration. The upcoming Bitcoin halving cycle is just one of many factors that could affect the market in the coming months, and investors should be prepared to adapt their strategies as needed to navigate this rapidly evolving landscape.