Successful trading strategies are built upon the foundation of discipline. Without discipline, even the most promising trading strategy will not yield positive results. Therefore, before delving into the technical aspects of a trading strategy, it’s crucial to develop the necessary self-control and consistency. It’s only through discipline that technical indicators and risk management can effectively work towards achieving trading goals.

There are so many ways to trade. I have tried several. Day trading, swing trading, bot trading, Hodling. Buy the dip. Resistance. Support, Overbought, oversold, Fibonacci ratios, Moving averages, MACD. They all have pros and cons, but in the end, it comes down to two things. Emotions and patience and what kind of discipline you can built to control those two things. Your emotions can destroy you in a matter of seconds and without patience, you will most likely never be able to be a consistently profitable trader no matter what the strategy is. I keep a journal where I write down what I did wrong, what I did write, and also what my emotions are. It is part of the plan.

This is not financial advice, but it is my personal rule book based on the little experience I have. If I have learned anything from the last few years of trading and had to sum it all up for you these are the five lessons I have learned that have helped me survive so far. For all five steps I cannot stress this enough controlling emotions and being patient is key.

1. You must develop a Trading Plan

A well-defined trading plan includes clear entry and exit points, risk management strategies, and a disciplined approach to trading. As a trade you must have a plan in place before entering any trade, and stick to that plan regardless of market conditions. Know when to get out. It is part of the plan. Set your stop loss first. What are you willing to lose? You must protect your account first at all costs. Profits will always come. It is the loses that can wipe you out quicker than anything.

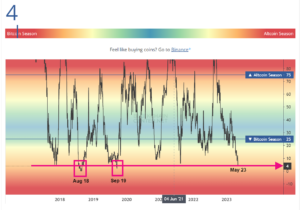

2. Focus on Market Trends

Its important to understand market trends. Getting caught up in short-term market fluctuations can destroy your account. Instead focus on the big picture. Larger/longer time-frames work best for that.

3. Manage Your Emotions

It’s important to manage your emotions effectively. The most successful traders maintain a level head and avoid making impulsive decisions based on fear, greed, or other emotions. This is one of the hardest ones to overcome. Take the small loss. Exit the market and reflect a little. Be patient. There are always trades to be made out there.

4. Learn from Your Mistakes

Trading involves a certain degree of trial and error. The most successful traders are those who are willing to learn from their mistakes. Try keeping a trading journal to track you performance and identify areas for improvement. This is so valuable if you are able to learn from the mistakes. Everyone makes mistakes.

5. Remain Humble

The market is unpredictable, no one can predict it with absolute certainty. You must approach the market with a sense of humility and respect for its power.