COMP is the native token of the Compound platform, which is a decentralized protocol for lending and borrowing cryptocurrencies. COMP was created in 2020 and is designed to play a key role in governing the platform, as well as incentivizing users to provide liquidity to the platform.

COMP is significant in the world of cryptocurrencies and blockchain technology because it represents a new model for decentralized finance (DeFi) that allows users to earn yields on their cryptocurrencies without having to rely on traditional financial institutions. By holding and using COMP tokens, users can participate in the governance of the Compound platform and potentially earn rewards for providing liquidity.

In addition, COMP has gained attention as an example of the growing trend of governance tokens in the DeFi space, which enable users to have a say in how decentralized protocols are managed and developed. As such, COMP has become a popular investment opportunity for those interested in the DeFi space and the potential for decentralized finance to disrupt traditional financial systems.

Brief History of COMPOUND (COMP)

The Compound platform was launched in September 2018 by Robert Leshner, a former economist and startup founder. The platform is built on the Ethereum blockchain and is designed to be a decentralized protocol for lending and borrowing cryptocurrencies.

The platform allows users to earn interest on their deposited assets, such as cryptocurrencies like Ether and Dai, by lending them to borrowers who are willing to pay interest in exchange for access to the assets. The interest rates on the platform are determined by market supply and demand, which allows for dynamic and flexible rates based on real-time market conditions.

One of the key features of the Compound platform is its use of algorithmic interest rate models, which automatically adjust interest rates based on changes in market conditions. This allows for more efficient and accurate pricing of borrowing and lending rates, as well as increased liquidity on the platform.

In addition, the Compound platform is designed to be governed by its users through the use of a decentralized governance system, which enables token holders to propose and vote on changes to the platform’s protocol and governance policies. The COMP token plays a key role in this governance system, as it is used to vote on proposals and make decisions about the future direction of the platform.

How COMPOUND works

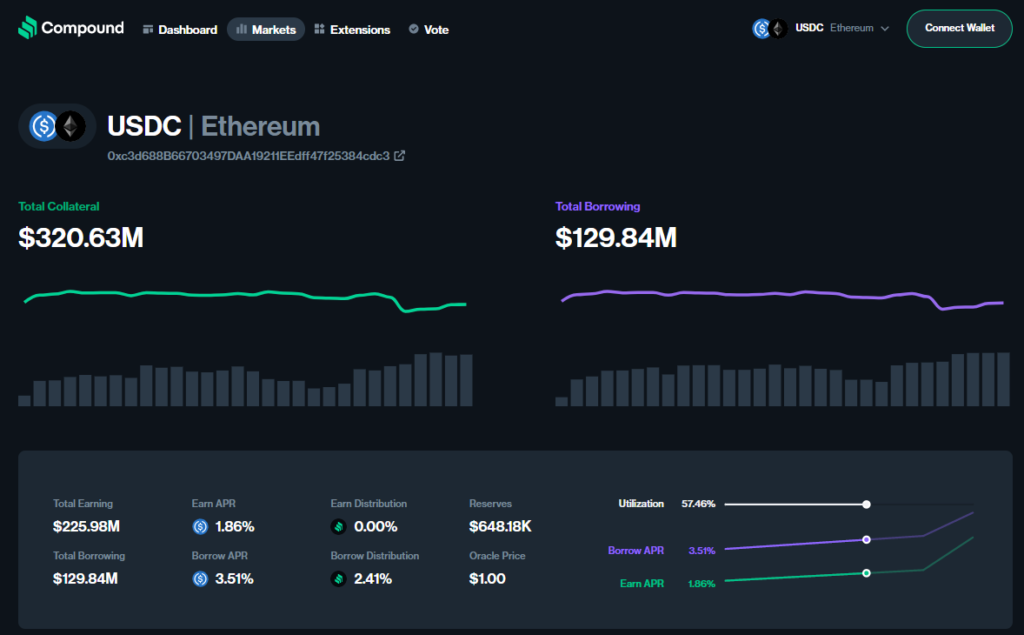

The Compound platform is a decentralized protocol that operates on the Ethereum blockchain. The platform allows users to lend and borrow various cryptocurrencies, such as Ether, Dai, and USDC. Users who lend their assets to the platform earn interest, while borrowers pay interest in exchange for access to these assets.

The platform uses a system of algorithmic interest rate models to determine interest rates based on supply and demand, which allows for real-time adjustments to rates based on market conditions. This system is designed to provide a more efficient and transparent lending and borrowing process compared to traditional financial institutions.

The COMP token plays a key role in the governance of the Compound platform. Holders of COMP tokens are able to propose and vote on changes to the platform’s protocol and governance policies, including changes to interest rates and other platform parameters. This gives users a voice in how the platform operates and develops over time.

In addition to its governance role, the COMP token also serves as an incentive for users to provide liquidity to the platform. Users who lend assets to the platform earn interest on those assets, as well as a portion of the daily distribution of COMP tokens. This means that by providing liquidity to the platform, users can earn both interest on their assets and additional COMP tokens, which can potentially increase in value over time.

The amount of COMP tokens distributed to users each day is determined by a formula that takes into account the total amount of interest generated on the platform and the percentage of that interest generated by each user’s contribution to the platform’s liquidity. This means that users who provide more liquidity to the platform are able to earn more COMP tokens over time.

COMP Advantages

Compound platform and holding COMP tokens can provide users with opportunities to earn high yields on their deposited assets, participate in the governance of the platform, and potentially benefit from price appreciation of COMP tokens. However, it’s important to note that investing in cryptocurrencies and DeFi protocols can be risky and users should carefully consider their own financial situation and risk tolerance before participating in these systems. Here are some advantages of using the Compound platform and holding COMP tokens:

- High yields on deposited assets: One of the main advantages of using the Compound platform is the potential to earn high yields on deposited assets. The platform offers dynamic and flexible interest rates that adjust in real-time based on market conditions, which can result in higher yields compared to traditional lending and borrowing systems. Additionally, by holding assets on the platform, users can earn both interest on their deposits and a portion of the daily distribution of COMP tokens.

- Participation in platform governance: Holding COMP tokens enables users to participate in the governance of the Compound platform. This means that users can propose and vote on changes to the platform’s protocol and governance policies, including changes to interest rates and other platform parameters. This gives users a say in how the platform operates and develops over time, which can lead to a more transparent and user-driven platform.

- Potential for price appreciation of COMP tokens: The value of COMP tokens is determined by market supply and demand, which means that their price can potentially appreciate over time as more users participate in the platform and demand for COMP tokens increases. Additionally, the daily distribution of COMP tokens to users provides an ongoing source of demand for the tokens, which can help to support their price.

- Decentralized nature of the platform: The Compound platform is designed to be decentralized, which means that it operates on a distributed network of computers rather than being controlled by a central authority. This can provide increased transparency and security compared to traditional financial systems, as well as greater accessibility to users around the world.

Risks

Users should carefully consider the risks and potential rewards of using the Compound platform and holding COMP tokens. While the platform and token offer the potential for high yields and participation in a decentralized system, there are also significant risks associated with investing in cryptocurrencies and DeFi protocols. Users should conduct thorough research and consult with a financial advisor before investing in these systems.

Here are some of the risks associated with using the Compound platform and holding COMP tokens:

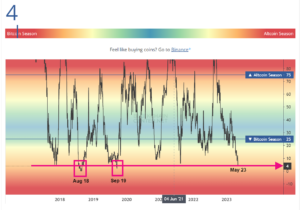

- Price volatility: Like other cryptocurrencies, the value of COMP tokens can be highly volatile and subject to fluctuations based on market conditions, investor sentiment, and other factors. This means that users who hold COMP tokens may experience significant gains or losses in the value of their holdings, which could potentially impact their overall investment portfolio.

- Security risks: The Compound platform and other DeFi protocols are vulnerable to a range of security risks, including hacking, smart contract vulnerabilities, and fraud. Users who deposit assets on the platform may be at risk of losing their funds if the platform is hacked or if there are other security breaches. Additionally, the decentralized nature of the platform means that users may have limited recourse in the event of a security breach or other problem.

- Regulatory challenges: As DeFi protocols continue to gain popularity, there is a growing risk of regulatory challenges from governments and financial regulators. Regulators may seek to impose new rules or restrictions on DeFi platforms, which could impact the viability and usability of the platform.

- Smart contract risks: The Compound platform operates on smart contracts, which are self-executing pieces of code that automatically execute certain functions. Smart contracts are subject to risks, including errors in the code or vulnerabilities that can be exploited by hackers. Users who interact with the platform through smart contracts should be aware of these risks and take appropriate precautions to protect their assets.

- Liquidity risks: The value of assets on the Compound platform is dependent on the availability of liquidity, which can fluctuate based on market conditions and user demand. Users who hold assets on the platform may experience liquidity risks if there are insufficient buyers or sellers to facilitate transactions.

Use Cases

COMP tokens can be used in a variety of ways within the DeFi ecosystem, and their flexibility makes them a valuable asset for users who are looking to participate in this emerging space. However, as with any cryptocurrency, users should be aware of the risks and potential rewards associated with investing in COMP tokens. Here are a few examples:

- Governance: COMP tokens are used to govern the Compound platform. Token holders can submit proposals for changes to the platform and vote on proposals submitted by others. The number of tokens held by a user determines their voting power.

- Lending and borrowing: Users can earn COMP tokens by lending or borrowing assets on the Compound platform. When a user provides liquidity to the platform, they receive interest payments in the form of the asset they deposited, as well as COMP tokens. Similarly, when a user borrows assets on the platform, they must pay interest in the form of the borrowed asset and COMP tokens.

- Trading: COMP tokens can be traded on cryptocurrency exchanges, similar to other cryptocurrencies. Users can buy and sell COMP tokens on these exchanges in order to speculate on their price or to hold them as an investment.

- Staking: Some DeFi protocols allow users to stake their COMP tokens in order to earn rewards or participate in other activities. For example, users can stake their COMP tokens in order to earn additional tokens, such as governance tokens or other cryptocurrencies.

- Incentives: Some projects use COMP tokens as a way to incentivize users to participate in their platform or ecosystem. For example, a DeFi lending protocol may offer COMP tokens as a reward for users who provide liquidity to their platform, in order to encourage more users to participate.

Summary

In terms of the potential impact of the Compound platform and COMP tokens on the future of cryptocurrencies and blockchain technology, it is clear that DeFi protocols like Compound are gaining traction as a more decentralized and transparent alternative to traditional financial systems. As more users participate in these platforms, the value of COMP tokens and other governance tokens is likely to increase, which could further incentivize participation and lead to even greater adoption.

Website: https://compound.finance/

The Blockchain Compound (this site), is covering topics related to DeFi protocols like Compound and cryptocurrencies in general because it is certainly relevant to the rapidly-evolving world of blockchain technology. We are attempting to help educate and inform our visitors about the potential advantages and hazards involved with using these platforms and investing in cryptocurrencies by offering in-depth analyses and insights into these topics. This can then encourage a better understanding and uptake of these new technologies.