3Commas Composite Bots Review

3commas has so many great features. In my opinion, it is the most powerful bot service out there at the moment for what it offers to its users. One of those features is having a paper trading account. What this does is allows you to set up and test bots in a “fake” account (not real money) I Highly recommend using this feature first and not using your real hard-earned money right away until you get used to how these bots work.

Now, this article lets go over how we can set up a composite bot in our paper trading account.

Composite Bots are probably the most powerful feature of 3commas. There are so many ways these bots can be set up and trade automatically for you creating passive income. In this article, we going to go over the interface and the basic options a user has when using composite bots.

The difference between a simple bot and a composite bot is that with the composite you can trade multiple pairs at the same time instead of just one.

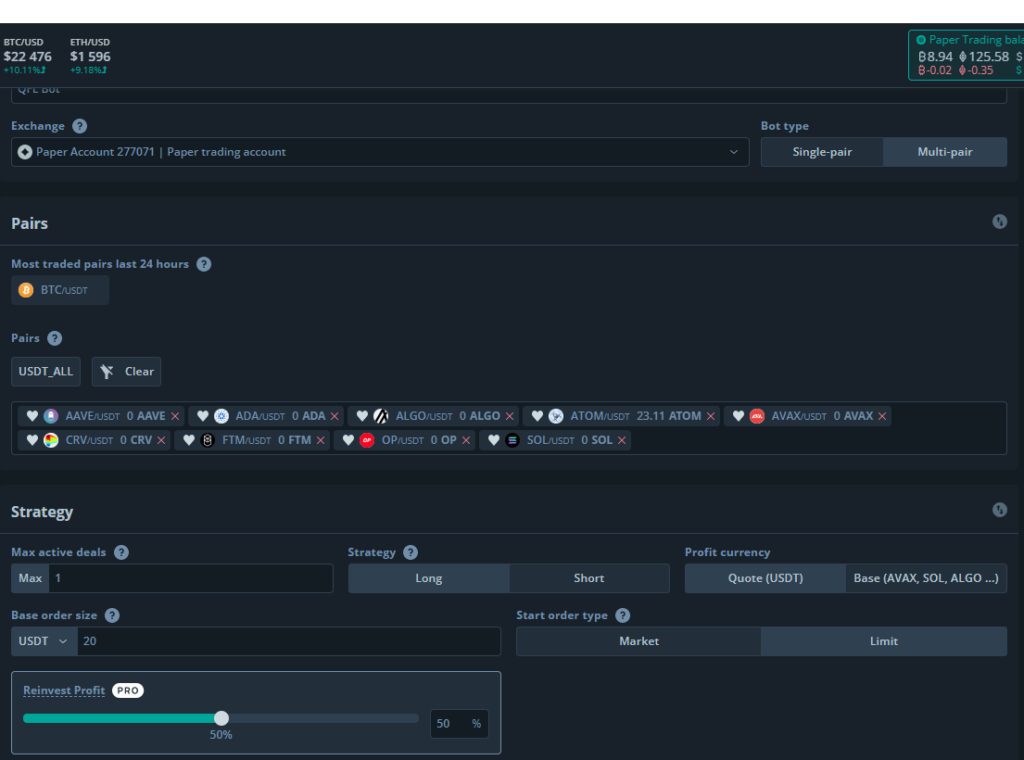

To start off you name the bot then select what pairs you want to trade with.

Next, we need to choose if the bot will be trading long or short. Note that if you are trading short you must already have a specific currency in your account. For example, if you create a short bot for Bitcoin (BTC) you must already hold BTC in your account. The Bot sells that and then buys it back at a lower price and the difference of that is your profit.

Then you can choose if you want the profits to be taken by the quote or base currency. that means if you are trading ETH with USDT for example you have the option to take profits in ETH (Base Currency) or USDT (Quote Currency).

Next, select your base order amount and if that order should be Market or Limit (I always recommend limit).

Finally, you want to set how many active deals you want to have. This is one of the benefits of running a composite bot with 3commas because you can have a selection of 100 coins and have the bot trade simultaneously with multiple deals following the same parameters you have preset. In this example, I set it to 1 but normally I would run 3 or 4 deals at the same time. Keep in mind that this affects the amount of capital used so the more deals the more money you need to run the bot obviously.

3commas has recently added a “Reinvest Profit” feature which I have not yet fully tested it basically compounds your profits which is great but its not something we will go over in this article.

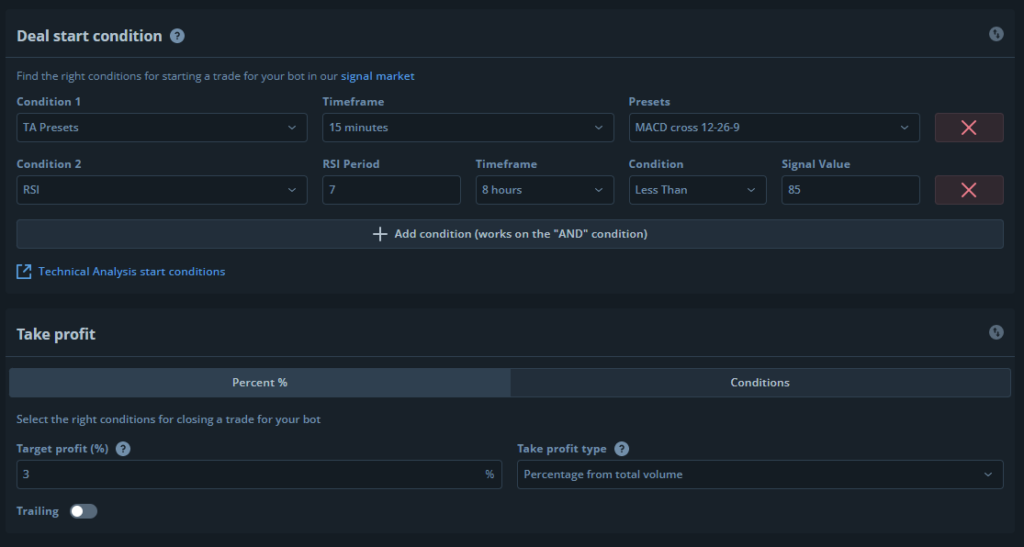

Now we are getting into the magic of the bots. The signals. What tells the bot to buy. You have so many settings and parameters and they continue to add more.

So here we want o set conditions. For this example, I am setting just 2 basic conditions. I am using the MACD crossover strategy which is one of the most popular ones for retail investors like you and me and has a good success rate if used correctly in the right market conditions specifically trending markets. In this example, I am using it on a 15-minute time frame.

The second condition I can set is an RSI. 3commas lets you pick from multiple timeframes. In this example, I am going to use the 8 hour and I am telling the bot that I do not want to open a deal if the 7-period RSI on the 8 hour timeframe is higher than 85 which is extremely overbought. This may help prevent the bot in getting caught buying really high.

Below that, I am not setting my Take Profit condition at 3%. This is up to you. Remember that these are automated trading bots that trade 24/7 which is incredible but they can often get caught in market dumps and then if you are not using a Stop loss, for example, you could get caught holding red bags for a while. Some like to take profits at 1% some like to be a little more aggressive. This is up to you. This is for educational purposes only and not financial advice.

3commas also offers a Trailing profit option. For this example, I am leaving it turned off but it is a pretty powerful feature. It follows the price past your set Take profit. I can set it at 0.2 for example and it will follow the price up until it dips down again by 0.2.

Now keep in mind it can go the other way too so if my take profit is set at 3% the reward is that if you catch a coin pumping which happens in crypto you could end up with a larger profit but if it does not go up then it will close 0.2 below that so some deal may close at 2.8% and if the coin is very volatile sometimes it may miss that too so you have to be familiar with what market you are in and what coin you are using when using this feature.

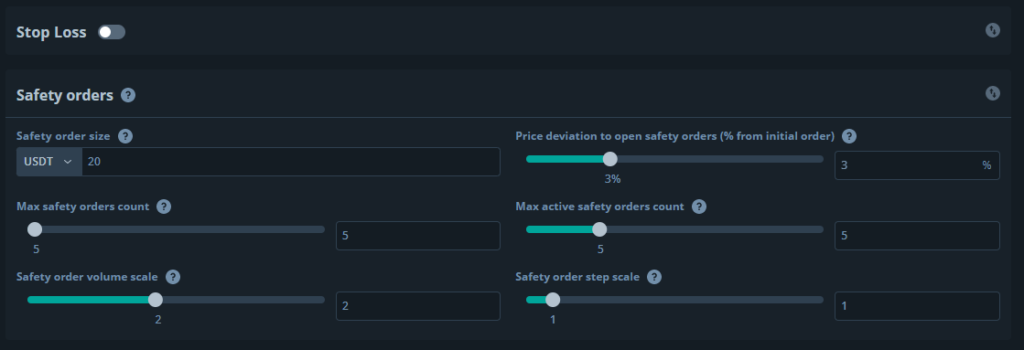

The next set of features we are going to look at is what 3commas calls “Safety Orders” in essence this is the DCA (Dollar Cost Averaging) feature of the platform and it’s fantastic.

Here you can set an order amount and then basically the bot will keep buying as the price moves down lowering your entry price and increasing your position.

Note that here you can set a stop loss as well but for this bot, I am leaving it turned off. After using and testing bots on this platform for nearly 3 years I have learned to manage the bots manually without a stop loss.

With my base order at $20 I am not setting a Safety order at $20 as well. Let’s go over the next options.

Price Deviation: here I am telling the bot where that second buy is. in this example, I am saying that if the price falls 3% below my entry price the bot will buy another $20.

Max safety orders: here I am telling the bot how many times I want to buy. I have set it to 5 meaning that the bot will buy 5 more times if the price keeps dropping.

Max active safety orders: here you can set how many orders you want to have placed on the exchange. It does not have to be all 5. In this example, I do have do set to 5 meaning that all 5 of my safety orders are placed on the books and ready to go. A benefit of this would be if you are trading a volatile coin that constantly wicks up and down and you are wanting to catch those wicks down quickly.

Safety order volume scale: here you will see I have set it to 2. What this does is tell the bot that for every safety order placed I want to multiply my position size x2 so if my first safety order was $20 the second safety order will be $40 and the 3rd safety order will be $80 ($40 x2). So the more the price falls the more I am buying. By doubling the size I am lowering my average price in half.

Safety order step scale: finally in this setting I have let it at 1 but what this does is it multiplies the price deviation you have set. In this example, it was set to a 3% price drop. With that setting of 1 all 5 of my safety orders will be placed after a 3% drop: 3% then 6% then 9% etc. If I change that setting to 2 for example then after the first safety order at 3% the second safety order would be placed at 9%. This setting allows you to expand and cover larger market dips (or crashes).

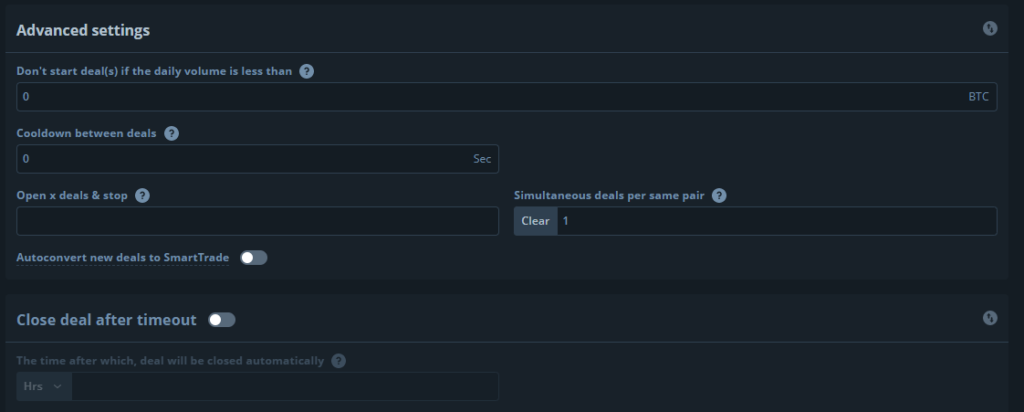

For this bot, I am not utilizing any of the 3commas advanced features but these can be very useful for filtering out bad deals. For example, here you can tell the bot to not start any deals if the volume is too low. This way you don’t get stuck with a coin that is not moving much. With bots, volume is your friend. You want to be in and out of deals fast. You can also set a cooldown period between deals meaning if a bot is constantly opening deals with a coin that is pumping you could tell it to wait a few minutes before opening another deal to avoid catching it at the top.

Simultaneous deals per pair are where you tell the bit if it can open multiple deals at the same time with the same coin.

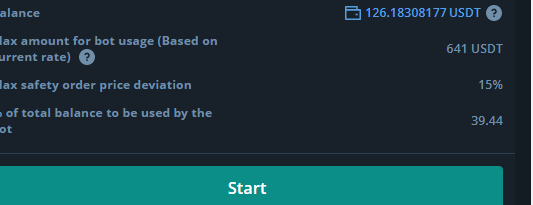

Now we are complete with this simple setup. Before I hit the start button another great feature that 3commas offers is the review data section. In this screen it tells you what amount your bot will need to run with all the safety orders. So in this exampel if my base order and all 45 safety orders were filled the bot would need $641 to fill all those orders. The price would have to drop by 15% for all those orders to be filled. Below they also offer a table that shows more details on how this may look.

As you can see on the image above this is how our setup foe this composite bot would look like.

It helps you understand more how the average price is calculated and what needs to happen for you to take profit.

So in this example the bot selected to trade AVAX/USDT

my order price was $15.76. My base order was $20 which got me 1.27 coins. If the market crashed and all 5 orders got filled then you see that your position would then be $640 holding 46.3 AVAX coins at an average price of $13.89

SO the average buy price has lowered significantly which means with that 3% take profit condition you originally needed the price to go to $16.23 to take profit now the bot needs to get to $14.24 (below your initial buy price) to take a 3% profit. Even though the price may have dropped -15% you only need a 6.3% increase to take that profit.

This is where the magic of DCA happens! That is all for this article. I hope this was helpful and explain in a real normal -retail trader – kind of way.

Bot Performance

I Highly recommend following TTP on YouTube for better understanding these bots. The Trading Parrot is a fantastic resource for all kinds of 3commas bot setups. He is very transparent, honest and thorough on his analysis. Tis video is from back in 2021 to show you how well some of these bots can perform in a bull market. He has done many videos during this bear market as well.

I have been personally following TTP from the beginning since he had less than 300 subscribers. His channel has grown exponentially since because of his great relatable content.